As we kick off the new year, it’s essential to start planning ahead for your taxes. Staying organized and informed can help you avoid any last-minute stress when tax season rolls around. Here are some key dates and deadlines to mark on your March 2026 Tax Calendar.

It’s crucial to keep track of important tax deadlines to ensure you meet all your obligations and avoid any penalties. By staying ahead of the game, you can make the tax season a breeze and focus on what matters most to you.

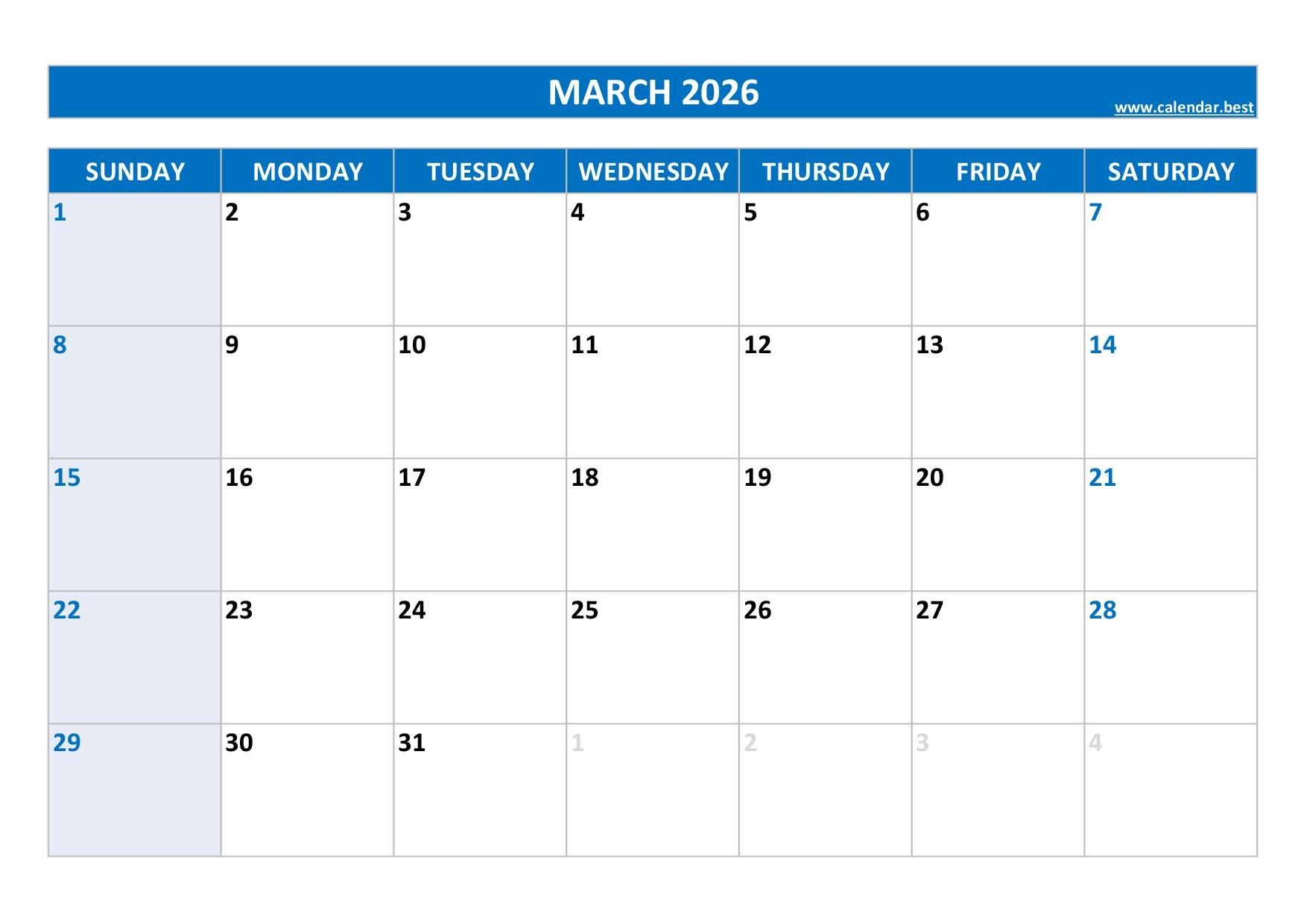

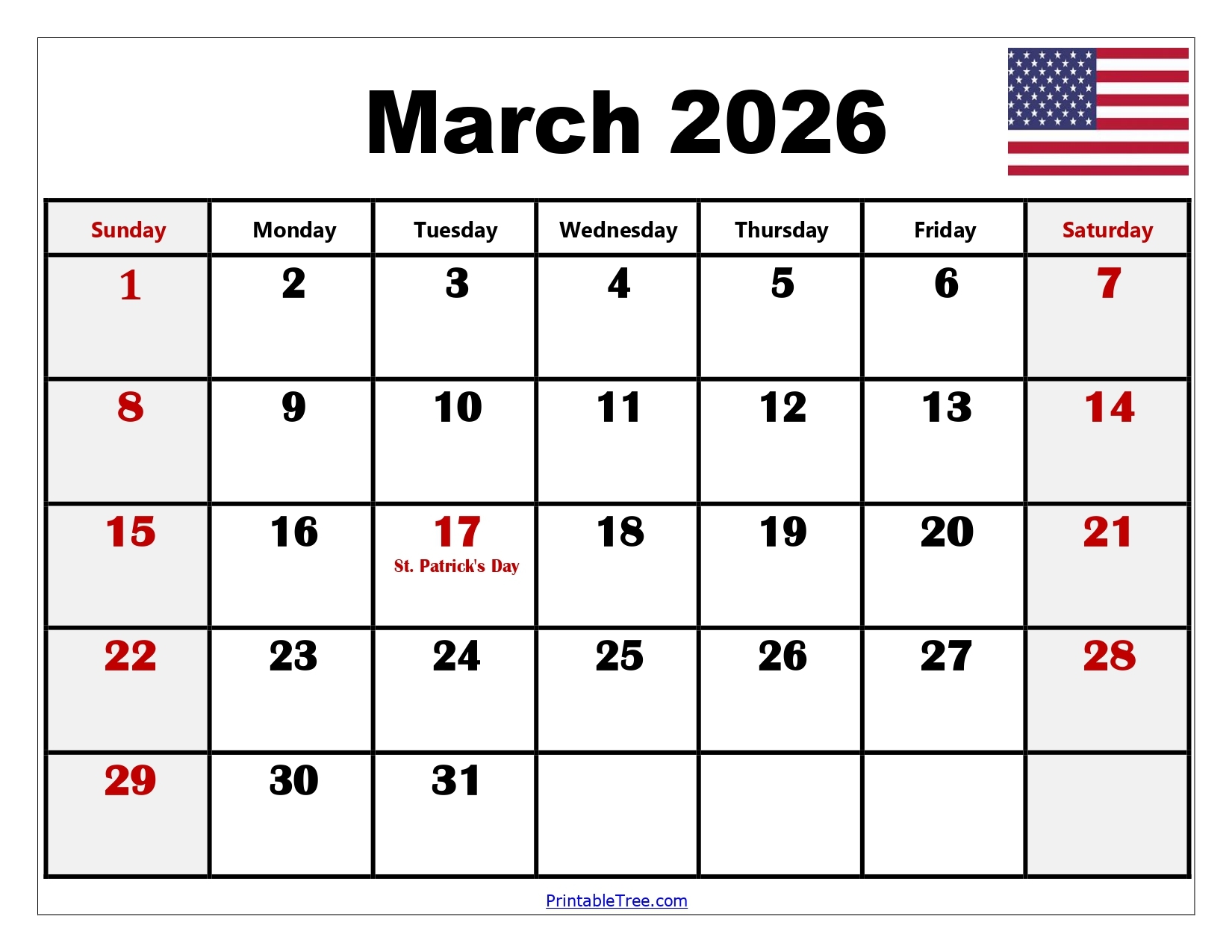

March 2026 Tax Calendar

March 2026 Tax Calendar

1. March 15, 2026 – Deadline for partnerships and S corporations to file their tax returns. Make sure you have all your documents ready and submit them on time to avoid any penalties.

2. March 31, 2026 – Deadline for electronic filing of Forms 1097, 1098, 1099, 3921, 3922, and W-2G. Ensure you report all necessary information accurately to the IRS.

3. March 31, 2026 – Deadline for businesses to file their annual reports and pay any associated fees. Check with your state’s requirements to stay compliant.

Keeping track of these key dates and deadlines on your March 2026 Tax Calendar can help you stay organized and avoid any last-minute rush. By planning ahead and staying informed, you can make tax season a smooth and stress-free experience. Remember, it’s never too early to start preparing!

Blank March 2026 Calendar Printable PDF Templates

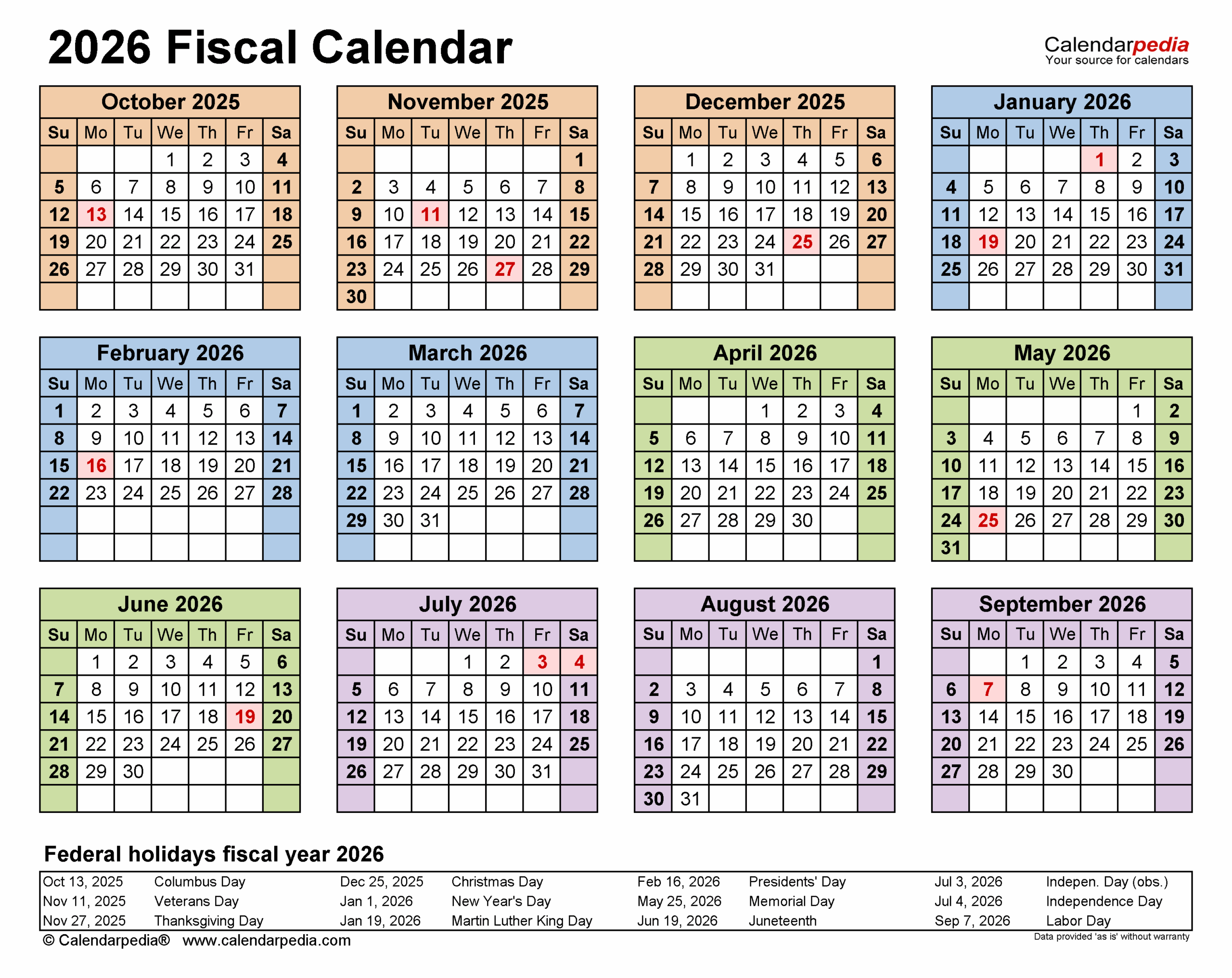

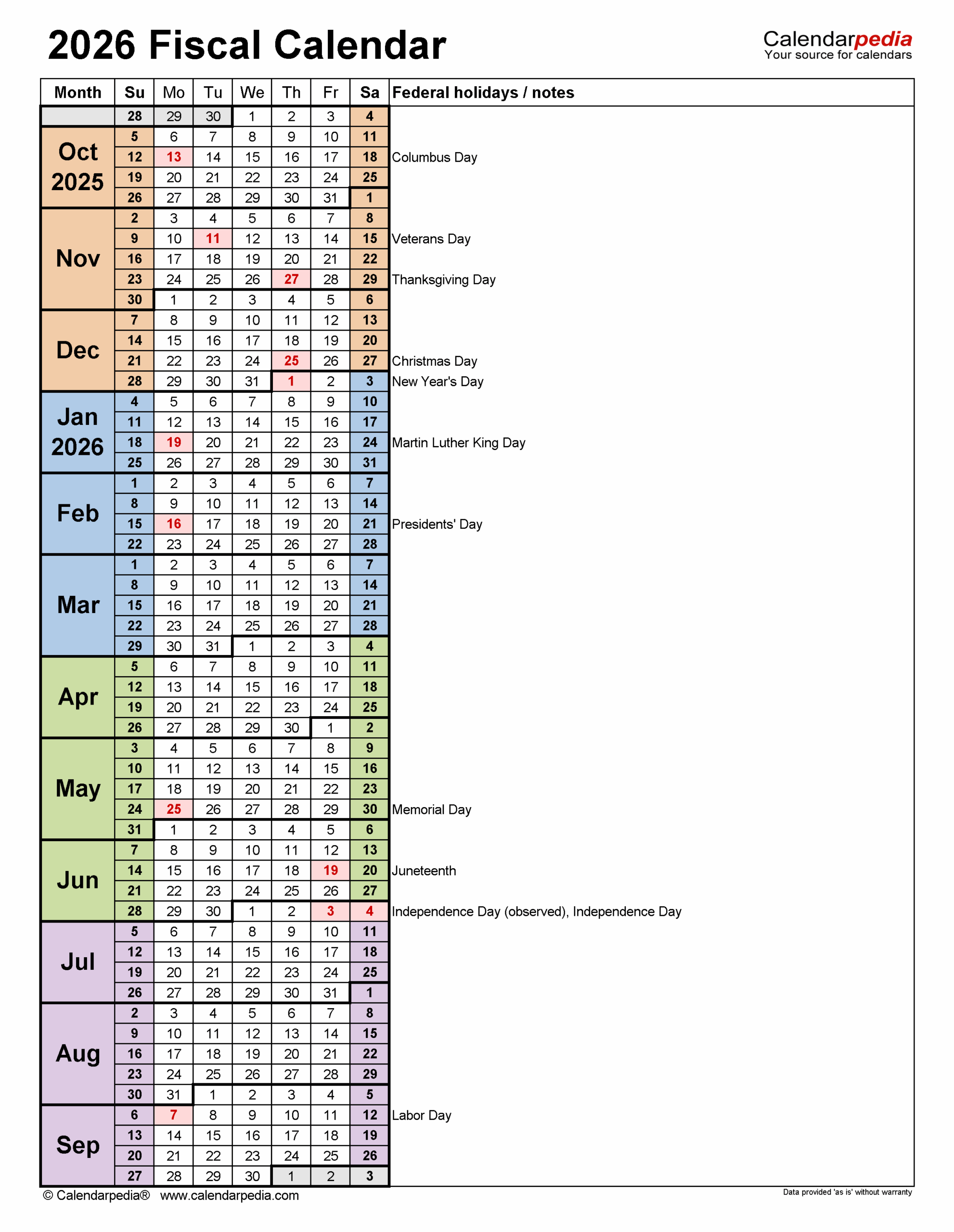

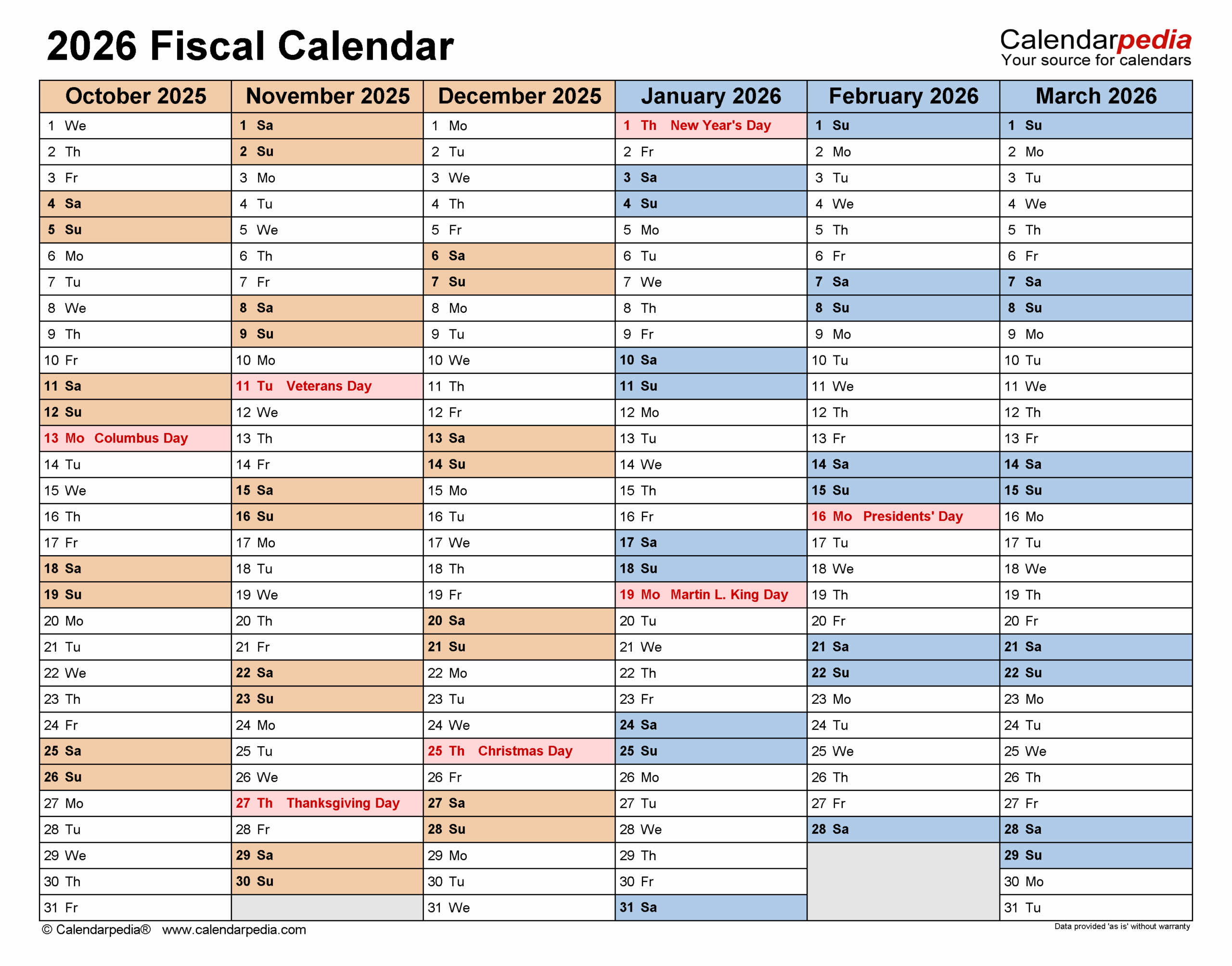

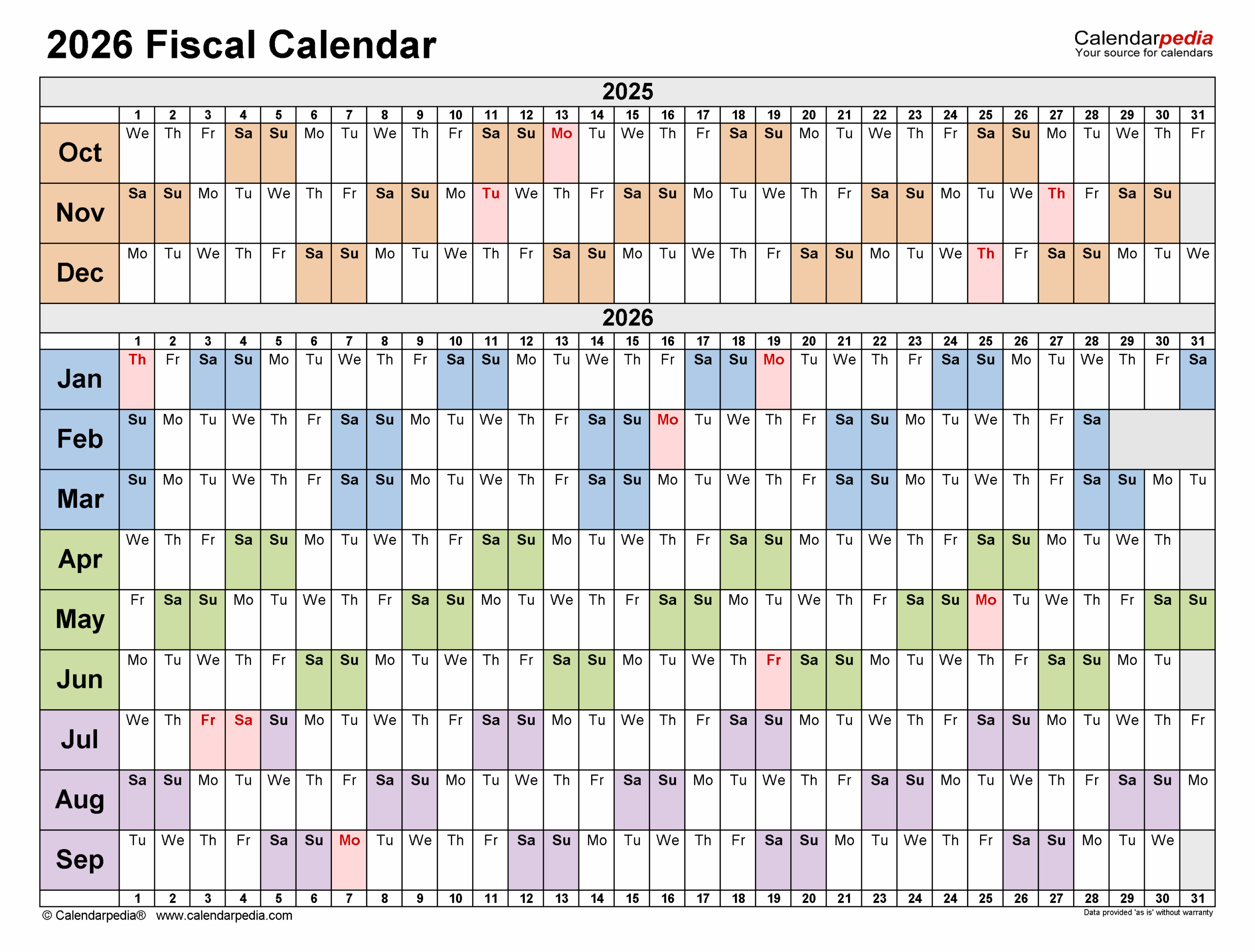

Fiscal Calendars 2026 Free Printable PDF Templates

Fiscal Calendars 2026 Free Printable PDF Templates

Fiscal Calendars 2026 Free Printable PDF Templates

Fiscal Calendars 2026 Free Printable PDF Templates