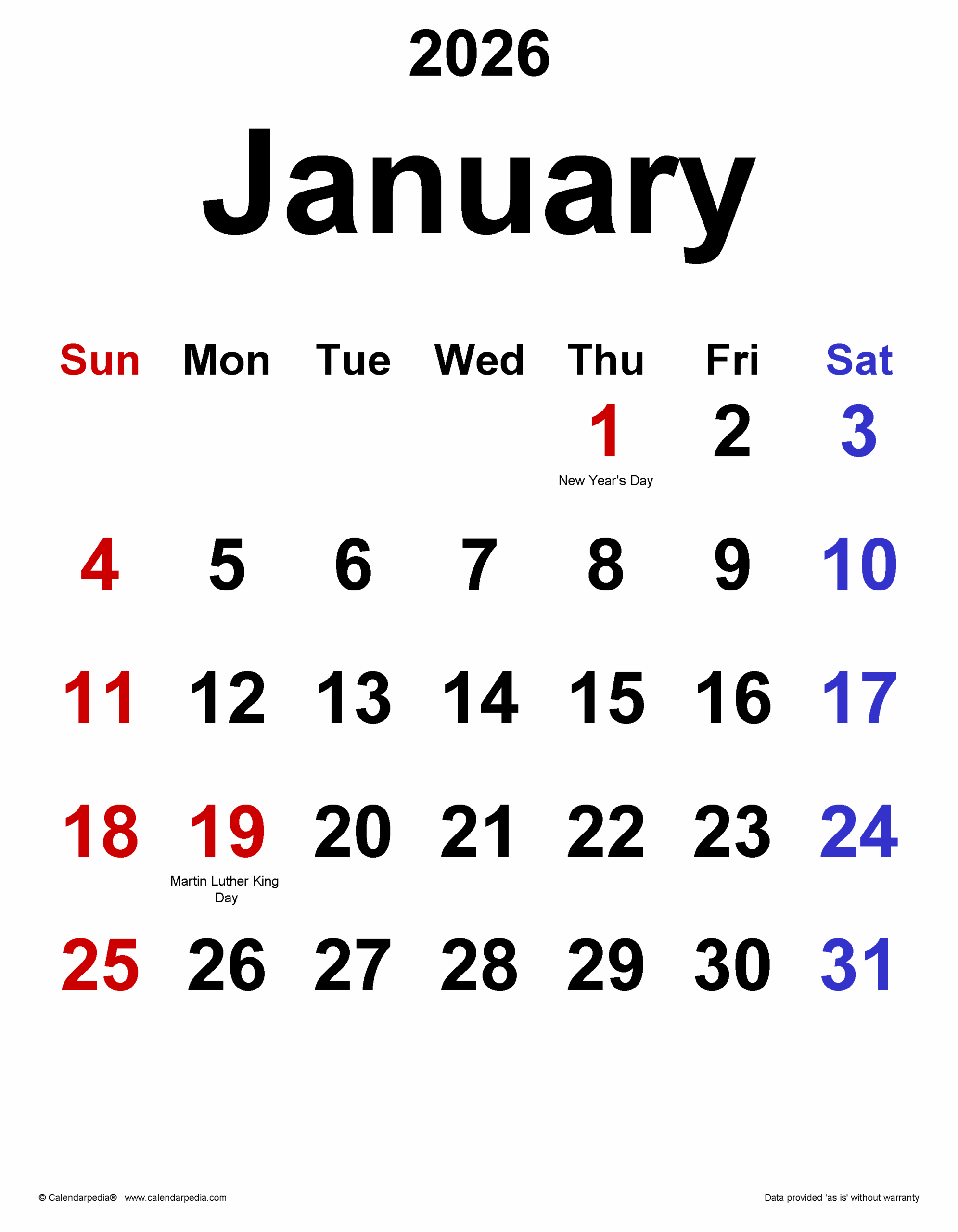

Are you ready to tackle the new year and stay on top of your tax obligations? January 2026 is here, and it’s time to start planning ahead with the Tax Calendar January 2026.

As you navigate through the first month of the year, it’s essential to keep track of important tax deadlines and obligations to ensure you stay compliant and avoid any penalties or fines.

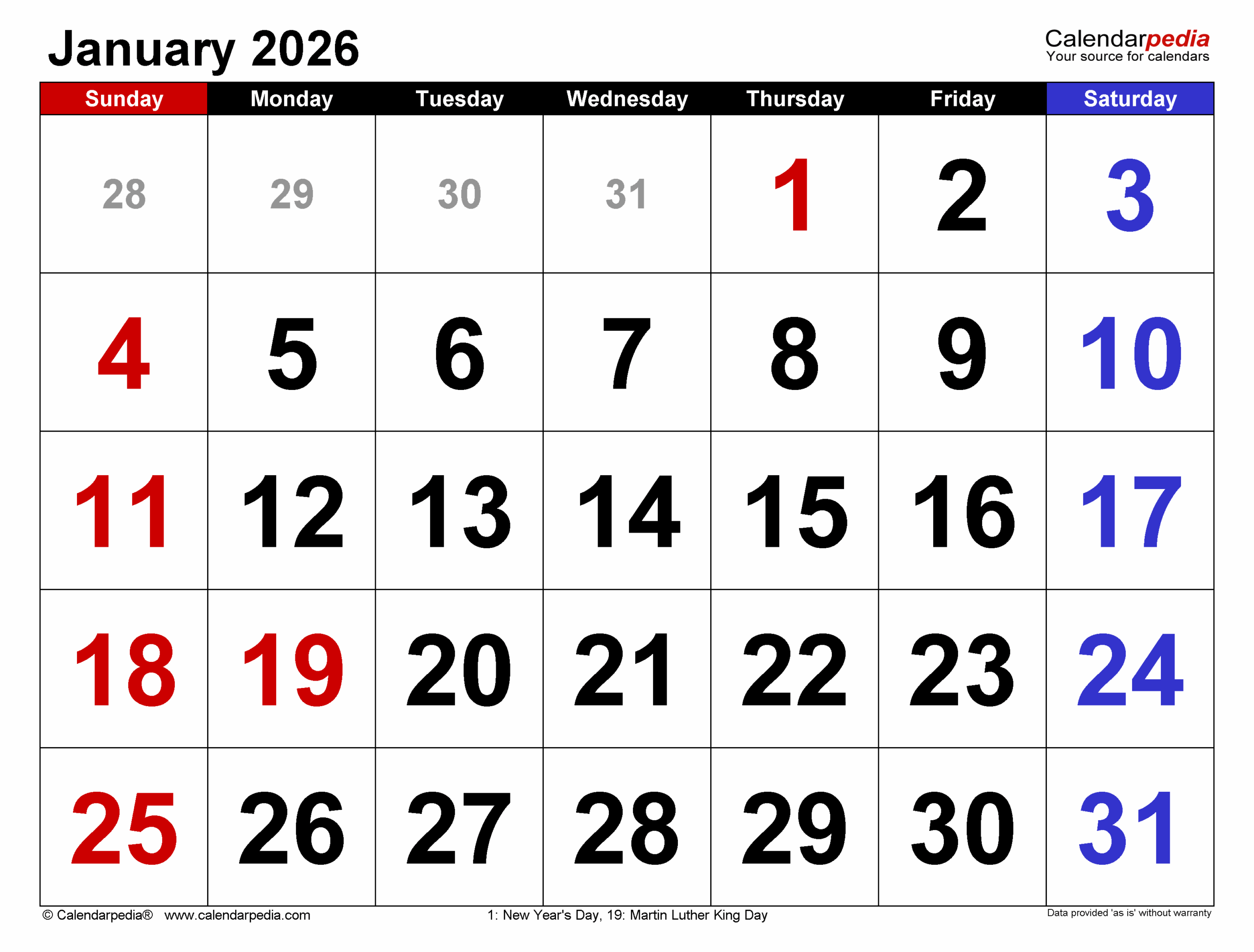

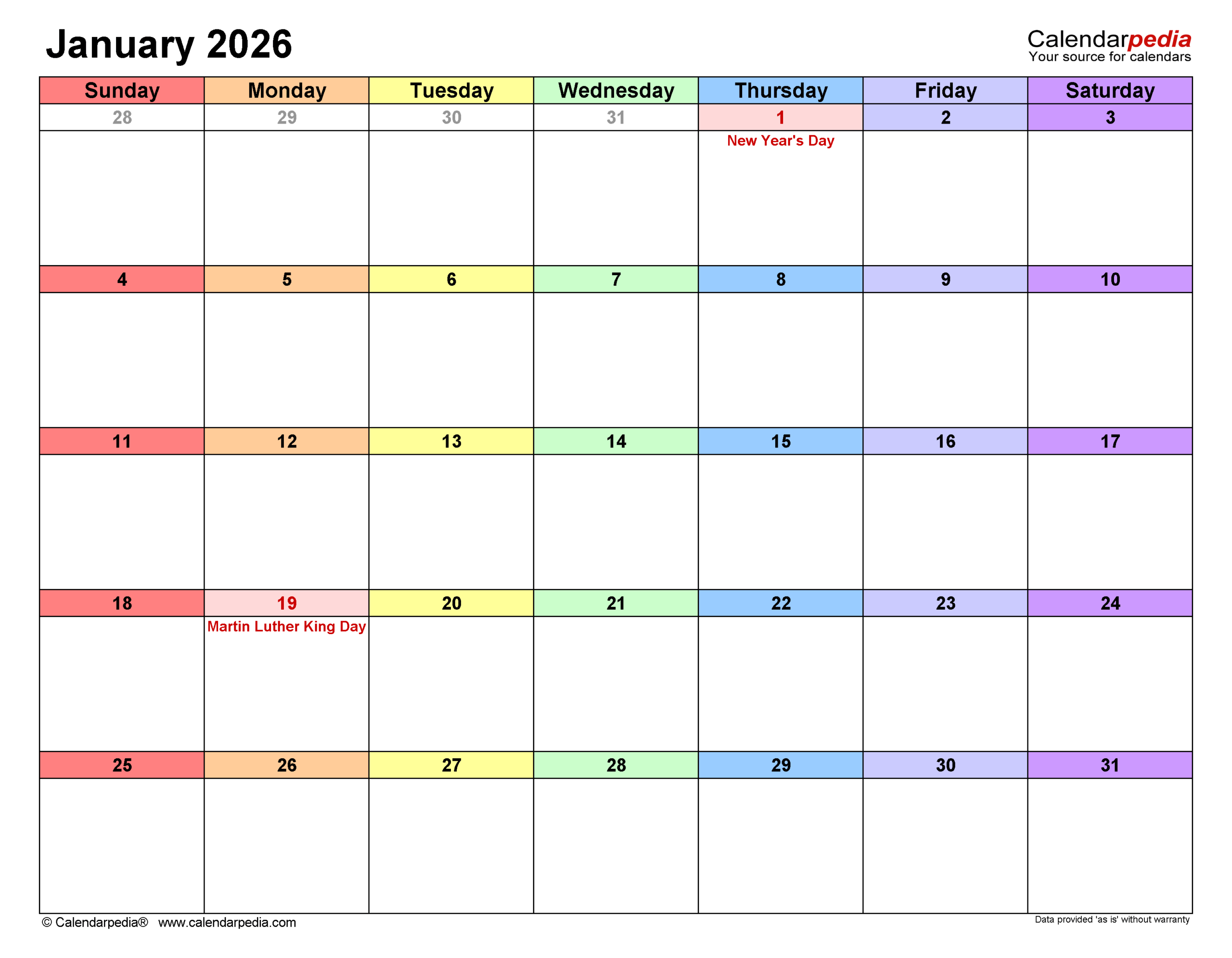

Tax Calendar January 2026

Tax Calendar January 2026

One of the key dates to remember in January is the deadline for employers to provide W-2 forms to employees. This form includes important information about wages earned and taxes withheld, so make sure to distribute them on time.

Additionally, self-employed individuals should start gathering all necessary documents and receipts to prepare for filing their taxes. Deductions and credits can help reduce your tax liability, so be sure to keep track of all eligible expenses.

If you’re expecting a tax refund, filing early can help you receive your money sooner. The sooner you file, the sooner you can get your refund deposited into your bank account or receive a check in the mail.

Stay organized throughout the month by setting reminders for important tax deadlines and milestones. By staying on top of your tax obligations, you can start the year off on the right foot and avoid any unnecessary stress or last-minute scrambling.

With the Tax Calendar January 2026 as your guide, you can navigate through the month with confidence and ease. Remember to stay proactive, keep accurate records, and seek professional help if needed to ensure a smooth tax season ahead.

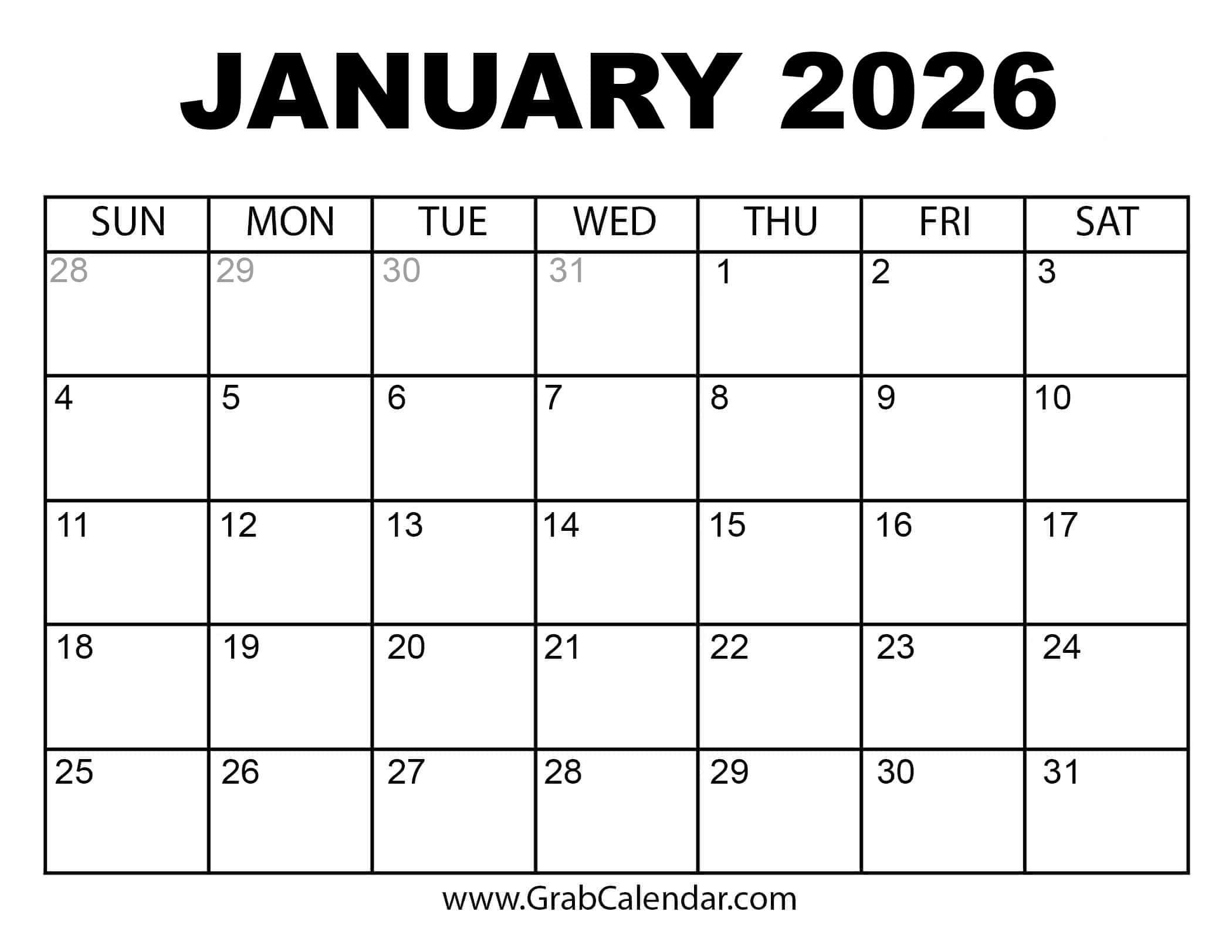

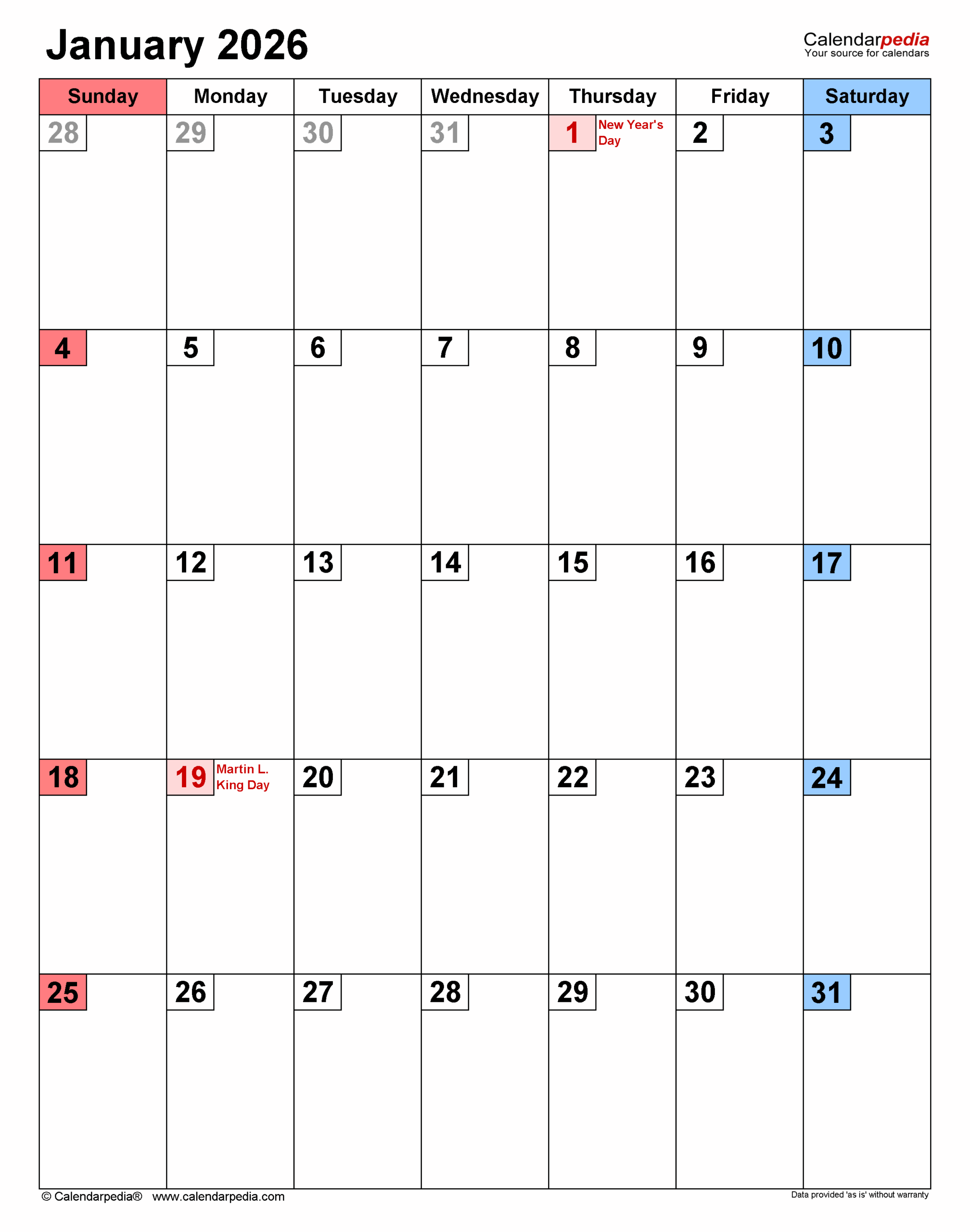

Printable January 2026 Calendar

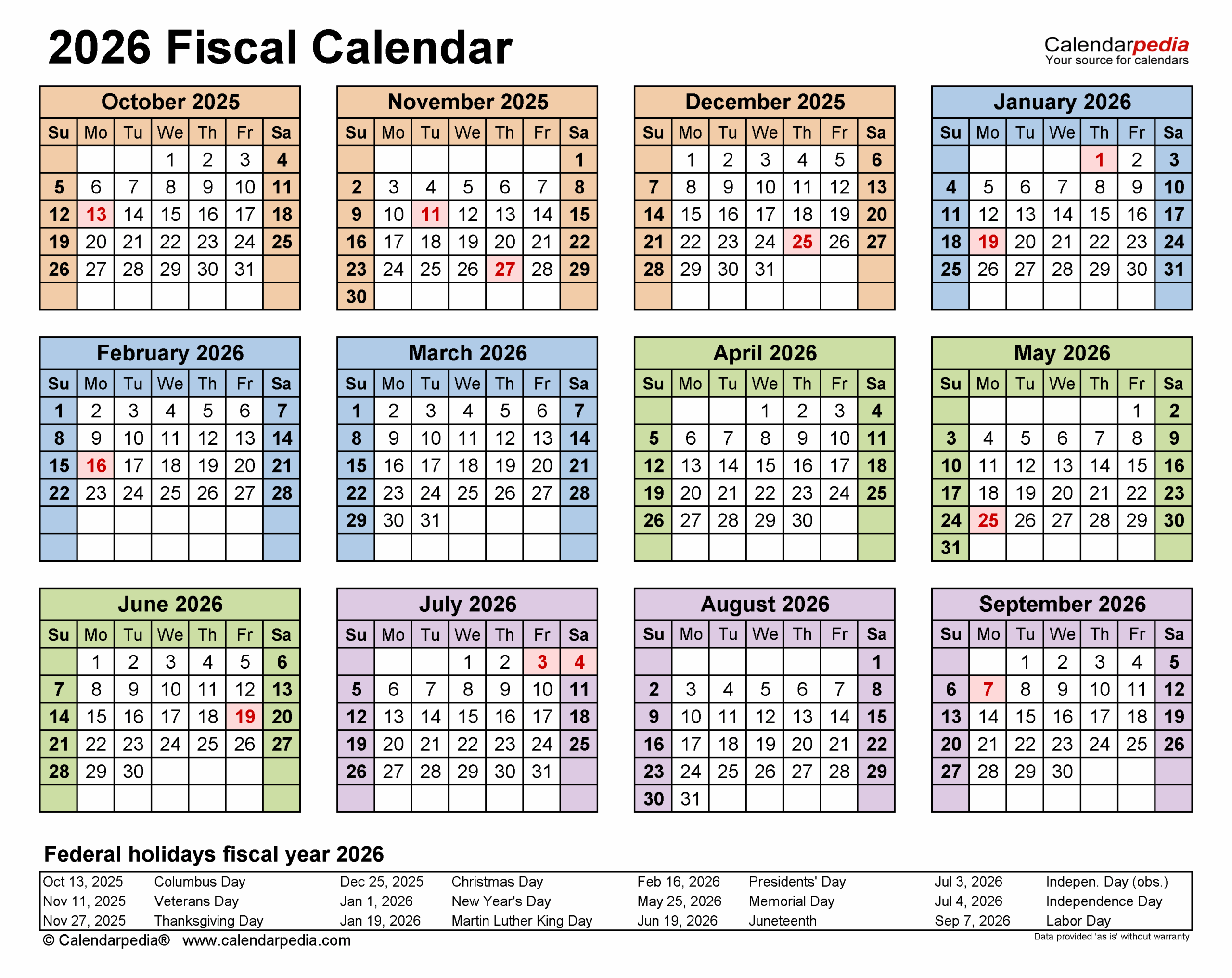

January 2026 Calendar Templates For PDF Excel And Word

January 2026 Calendar Templates For PDF Excel And Word

January 2026 Calendar Templates For PDF Excel And Word

January 2026 Calendar Templates For PDF Excel And Word